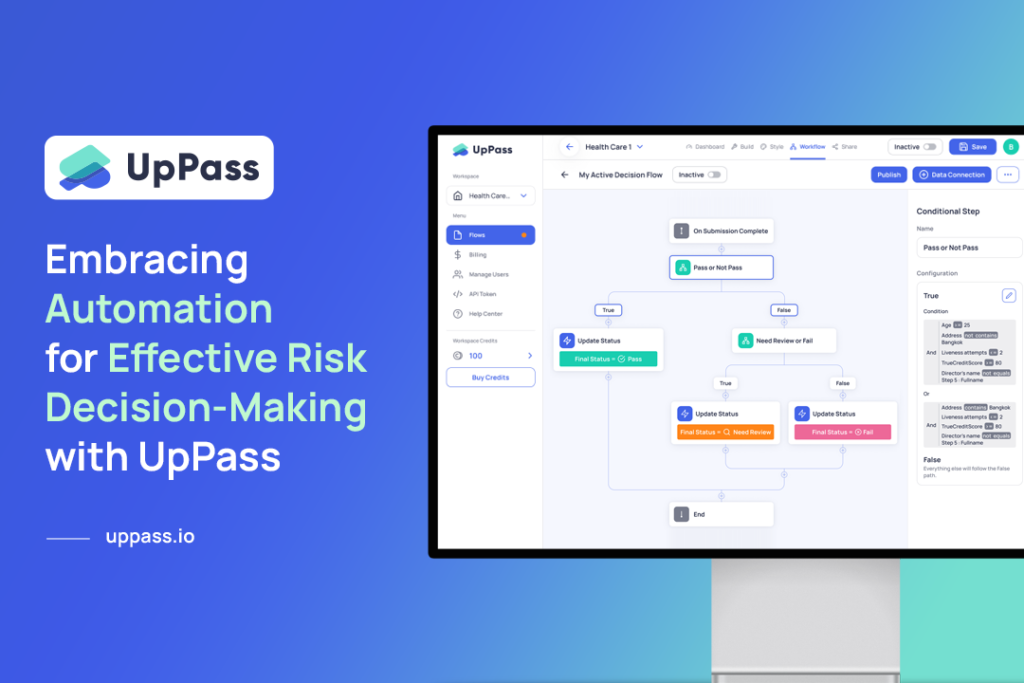

The Benefits of Automated Risk Decision Tools for eKYC/eKYB and Compliance

In today’s complex and fast-paced business environment, effective risk management is crucial for achieving sustainable success. However, traditional methods of risk assessment and decision-making often struggle to keep up with the growing volume and complexity of risks faced by organizations. Fortunately, by embracing automation, businesses can unlock a wide range of benefits that enable them to proactively manage risks and seize opportunities. This article explores why businesses should adopt the automation of risk decisions to enhance resilience and drive operational excellence.

1. Increased Efficiency

Automating risk decision tools allows organizations to significantly improve the efficiency of their risk management processes. Manual evaluation and decision-making are time-consuming and prone to human error. Automation streamlines the process, enabling quicker assessments and decisions. By automating manual risk assessments and decision-making processes, organizations can reduce the time and resources required. Automated risk decision systems can rapidly analyze vast amounts of data, identify patterns, and generate real-time insights. This agility enables businesses to promptly respond to emerging risks, minimizing potential damages and facilitating proactive risk management strategies.

2. Consistent and Objective Decision-Making

Automation eliminates inconsistencies and biases that may arise from manual decision-making. Automated risk decision tools follow predefined rules and algorithms, ensuring consistent and objective decisions based on available data and criteria. Achieving consistency and standardization across the organization is a key advantage of automating risk decisions. Human judgment can vary, leading to inconsistencies and biases in risk evaluations. By employing automated systems, businesses can establish predefined algorithms and decision rules that ensure a consistent and objective assessment of risks. This consistency promotes fairness, reduces errors, and enables reliable comparisons across different risk scenarios.

3. Improved Accuracy

Automated risk decision tools leverage advanced algorithms and data analytics, enabling organizations to make more accurate risk assessments. These tools can analyze large volumes of data, identify patterns, and detect potential risks or anomalies that may be overlooked by manual methods. Accurate risk assessment is crucial for businesses to identify potential threats and opportunities. Automated risk decision systems use predefined algorithms and data-driven analysis to deliver more accurate risk evaluations. By removing human error and biases, these systems comprehensively evaluate multiple risk factors simultaneously, resulting in more precise and reliable risk assessments. Enhanced accuracy enables businesses to make informed decisions that align with their risk appetite and optimize resource allocation.

4. Real-time Monitoring and Alerts

Automated risk decision tools continuously monitor and analyze data, providing real-time insights into emerging risks. This proactive approach allows organizations to promptly identify and address potential risks, minimizing their impact on business operations. Risk landscapes are dynamic, and businesses need to continuously monitor and adapt their risk management strategies. Automated risk decision systems enable ongoing risk monitoring by analyzing real-time data and identifying emerging trends or changes in risk profiles. With timely alerts and actionable insights, businesses can proactively adjust their risk mitigation strategies, effectively managing risks and minimizing their impact on operations.

5. Cost Savings

Automating risk decision processes reduces the need for manual resources and repetitive tasks, resulting in cost savings in terms of time, labor, and potential errors. Additionally, timely risk mitigation through automated tools can prevent costly incidents and damages. Automation of risk decisions can lead to significant cost savings for businesses. Manual risk assessment and decision-making processes require dedicated resources, which can be expensive and time-consuming. By automating these processes, businesses can reduce the need for manual labor, allowing employees to focus on higher-value tasks. Furthermore, automated systems can identify cost-saving opportunities by optimizing risk management strategies, improving resource allocation, and uncovering areas for efficiency gains.

6. Scalability and Adaptability

Automated risk decision tools can easily scale to accommodate increasing data volumes and evolving risk landscapes. They can adapt to changing regulations, industry standards, and organizational requirements, ensuring effective and up-to-date risk management. Scalability becomes crucial as businesses grow and face evolving risk landscapes. Manual risk decision-making processes can become overwhelmed by increasing volumes of data and complexity. Automation provides the scalability required to handle these challenges effectively. Automated systems can process and evaluate large amounts of data efficiently, adapt to changing risk profiles, and accommodate the expanding needs of the organization. This scalability enables businesses to seamlessly scale their risk management efforts, supporting growth and mitigating potential bottlenecks.

7. Enhanced Compliance

Automating risk decision processes helps organizations adhere to regulatory requirements and compliance standards. By integrating compliance rules and guidelines into automated tools, organizations can ensure consistent adherence and reduce the risk of non-compliance. Compliance with regulatory requirements and internal governance frameworks is a critical aspect of risk management. Manual processes can introduce inconsistencies and increase the risk of non-compliance. Automating risk decisions ensures adherence to predefined rules and guidelines, minimizing the chances of errors and non-compliance. By incorporating regulatory requirements into automated systems, businesses can effectively manage risk while meeting legal obligations, protecting their reputation, and avoiding penalties.

8. Decision Transparency

Automated risk decision tools provide a clear audit trail of the decision-making process. This transparency allows stakeholders to understand the rationale behind decisions, facilitates communication, and supports accountability and governance.

Overall, automating risk decision tools offers numerous benefits, including increased efficiency, improved accuracy, real-time monitoring, cost savings, scalability, compliance, and decision transparency. By leveraging automation, organizations can enhance their risk management capabilities, make informed decisions, and effectively mitigate potential risks.

In an era characterized by rapid change and increasing complexity, businesses must be agile and resilient in their risk management practices. Automating risk decisions offers a compelling solution that provides consistency, speed, accuracy, scalability, compliance, cost savings, and adaptability. By leveraging automation, businesses can enhance their risk management capabilities, identify emerging risks promptly, and seize opportunities for growth and success.

Learn more about UpPass: Start for free & get 100 credits

Read more articles at https://blog.uppass.io